Cryptocurrency may be global, but taxes? Not so much. While Bitcoin knows no borders, your tax authority definitely does — and it wants a piece of the action.

In this post, we're breaking down how different countries treat crypto when it comes to taxation — from strict capital gains rules to zero-tax havens. Plus, we’ll drop some tools to help you stay compliant and sane during tax season.

Why Understanding Crypto Taxes Globally Matters

Crypto lets you move assets across borders instantly. But if you're a trader, investor, or even a digital nomad, where you live — and where you're taxed — makes a huge difference in what you keep versus what you pay.

For some, a simple change in residency can mean the difference between paying 30% in taxes... or zero.

Country-by-Country Comparison of Crypto Tax Rules

Here’s how some of the world’s most crypto-relevant countries are treating digital assets as of 2025:

United States: The IRS Is Watching You

Crypto is taxed like property. That means:

Every trade, sale, or use of crypto is a taxable event.

You must report capital gains (short- or long-term).

Staking, airdrops, mining — all taxable as income.

Even spending crypto triggers capital gains.

💼 Pro Tip: Want help organizing this chaos? Try CoinLedger or Koinly to import your wallets and auto-generate IRS-friendly tax reports.

Germany: HODL for Freedom

Germany rewards patient investors.

If you hold crypto for more than one year, gains are 100% tax-free.

Sell before a year? Taxed if profit exceeds €600.

Income-generating activities (like staking) are taxed differently.

🧠 Strategy: This is one of the few places where long-term holding gives you full tax exemption.

Portugal: Still Friendly, But Not Tax-Free Anymore

Portugal used to be a crypto tax haven. Now it’s crypto-light.

If you hold for more than one year, your gains are tax-free.

Sell within a year? 28% flat tax on gains.

Professional or high-frequency trading may be taxed as business income.

📍 It’s still a top pick for crypto expats — just make sure you stay under the radar of the new tax reforms.

Singapore: Minimal Hassle

Singapore doesn’t tax capital gains. That means:

Personal crypto trading? No tax.

But crypto earned through business or as income? Taxable.

Great regulatory clarity and innovation-friendly environment.

🏖️ Singapore is still one of the best spots for long-term crypto investors.

Australia: Transparency + Tax

Australia treats crypto as a CGT asset (capital gains tax).

Selling, trading, or spending crypto = taxable event.

Staking, mining = income, and must be reported.

If you hold for more than a year, discounts apply on gains.

✅ Bonus: The ATO offers better clarity than the IRS, but they’re also aggressive with audits. Use Koinly or CoinLedger to stay safe.

India: Flat and Frustrating

India’s stance is harsh:

30% flat tax on all crypto gains — with no loss deductions allowed.

1% TDS (tax deducted at source) on every transaction.

No exceptions, no sympathy.

📉 A tough environment for traders, especially those with high volume and low margins.

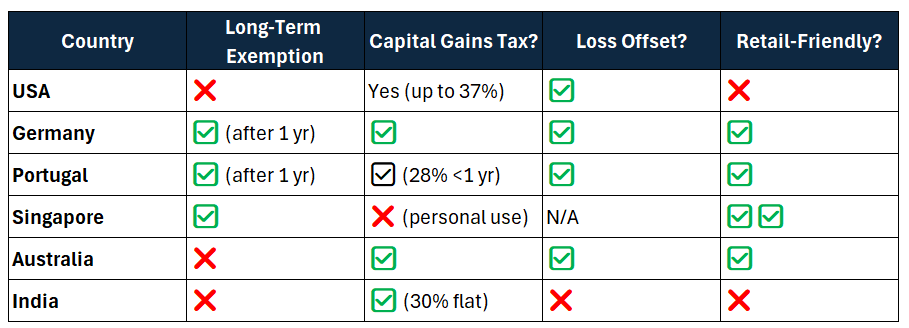

Quick Comparison Table

Must-Have Crypto Tax Tools

Want to stay compliant no matter where you live or trade? These tools can help you track, report, and protect your crypto:

CoinLedger – Import trades, DeFi, NFTs, staking, and more. Generates IRS-ready reports with ease.

Koinly – Excellent multi-country support, including for tax havens and hybrid residency.

Ledger – Keep your assets secure and tax-compliant with cold storage.

Trezor – A leading hardware wallet trusted by millions. Ideal for long-term holders in countries like Germany and Portugal.

(Affiliate Links)

Final Thoughts

Your tax obligations can change drastically based on geography — but ignorance isn’t a defense. Whether you’re staking, flipping NFTs, or yield farming on Arbitrum, you need a strategy that matches your jurisdiction.

The smartest move you can make in 2025? Get organized. Know the rules. Use the right tools. And if you're feeling overwhelmed — talk to a professional.

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Consult a qualified tax professional regarding your specific circumstances.

📌 Need help?

CoinFlask offers crypto tax advisory and reporting solutions tailored to your needs. Reach out for a consultation or check out our resources.

Check out tools like Koinly, or CoinTracker to simplify the process. (Affiliate links may apply.)

Got questions or want us to cover a topic? Follow us on Twitter @CoinFlask or subscribe to our newsletter for weekly insights.

Stay curious. Stay safe. Stack smart.