Understanding the Tax Implications of Cryptocurrency Airdrops and Giveaways

Cryptocurrency is more than just Bitcoin and Ethereum. If you’ve been in the crypto space for a while—or even if you’ve just started—you’ve probably heard of (or received) a crypto airdrop or entered a giveaway. These marketing tactics are common in Web3 to reward early adopters, increase project awareness, and distribute tokens broadly.

But here’s the part that surprises many people: airdrops and giveaways are taxable events in many countries, especially the U.S.

In this article, we’ll break down the tax implications of receiving airdropped tokens or giveaway rewards. We’ll explore how they're treated by the IRS, what you need to report, when you owe taxes, and how you can minimize surprises when tax season comes around.

What Are Crypto Airdrops and Giveaways?

Before we dive into taxes, let’s define the basics.

Airdrops

Airdrops are distributions of free crypto tokens, often to promote a new project or reward early users. You might receive an airdrop simply by:

Holding a specific cryptocurrency at a certain time (a "snapshot").

Signing up for a whitelist.

Participating in a project’s ecosystem (staking, voting, etc.).

You didn’t buy the tokens. They just appear in your wallet—free of charge.

Giveaways

Giveaways are promotional events where crypto projects or influencers hand out tokens (or NFTs) to lucky winners. Often, they ask participants to:

Follow social media accounts

Retweet or share posts

Join Discord channels

Complete small tasks (a.k.a. “bounties”)

If you’re selected, you receive free crypto or assets. But again: free does not mean tax-free.

How Are Airdrops and Giveaways Taxed in the U.S.?

According to IRS Notice 2014-21 and Revenue Ruling 2019-24, both airdrops and giveaways are generally treated as ordinary income at the fair market value (FMV) of the tokens on the day you gain control of them.

In plain English:

You owe income tax when the tokens hit your wallet, even if you didn’t sell them.

1. Airdrops = Ordinary Income

When you receive an airdrop, the IRS views it as a windfall—just like winning a prize or receiving a bonus at work.

Example:

You received 100 ABC tokens via an airdrop. On the day they land in your wallet, ABC is trading at $2.00 each.

You must report $200 as income on your tax return.

Even if the price drops to $0.10 later, you’re still taxed on the $200.

2. Giveaways = Prizes = Taxable

Crypto giveaways are treated like lottery winnings or prizes on game shows. If you win a giveaway and receive crypto worth $500, that full amount is taxable income, even if you didn’t sell it.

Some platforms may even issue a Form 1099-MISC to report this to the IRS if you earn more than $600.

When Is the Tax Triggered?

The key moment that creates a tax obligation is "dominion and control."

This means you:

Can access the tokens

Can transfer, sell, or use them

Are not restricted from accessing them (e.g., they’re not locked or pending)

For airdrops, the tax is triggered as soon as the tokens hit your wallet and are accessible.

For giveaways, the tax is triggered when you receive the reward and can use it.

How Is the Amount Determined?

The IRS requires you to report the fair market value in USD of the token on the date of receipt.

You can get this value by checking:

The exchange rate on centralized exchanges (like Coinbase)

Token trackers (like CoinGecko or CoinMarketCap)

Wallet activity logs or price history

Important: You’ll need to keep accurate records of:

The date you received the tokens

The value per token at that moment

The total number of tokens received

What Happens When You Sell the Tokens Later?

This is where things get tricky.

Once you’ve reported the airdropped or giveaway tokens as ordinary income, your cost basis is set.

Let’s say:

You received 100 tokens at $1 each.

You reported $100 as income.

You later sell them for $200 total.

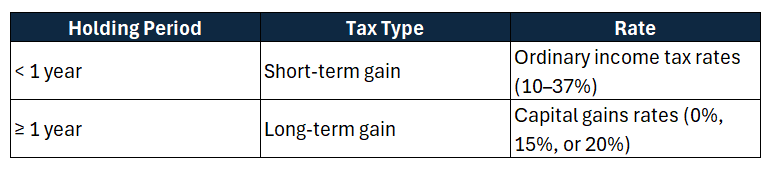

Now, you have a capital gain of $100, which must also be reported. The type of gain (short-term vs. long-term) depends on how long you held the tokens after receiving them.

So, airdrops and giveaways can potentially be double-taxed:

Once as ordinary income when received.

Again as capital gain/loss when sold.

How to Report Crypto Airdrops and Giveaways on Your Taxes

Here’s how to include them in your U.S. tax filings:

1. Report as Income

Include the value of tokens received via airdrops and giveaways as “Other Income” (typically on Schedule 1, Line 8z) of your Form 1040.

2. Report Capital Gains (If Sold)

When you later sell, swap, or use the tokens:

Report the sale on Form 8949

Include it in Schedule D (Capital Gains and Losses)

Calculate gain or loss based on your cost basis (the value you reported as income)

Special Cases and Grey Areas

Crypto taxation is still evolving, and some edge cases remain uncertain:

What if you didn’t claim the airdrop?

If the tokens were sent to a wallet but you never accessed or moved them, you may argue that you never had dominion and control—thus avoiding tax at that time. But this is risky, and you'd need strong documentation.

What if the token has no value at the time?

If the token isn’t trading on any exchange, and there’s no way to determine a fair market value, you may not need to report it yet. But once it becomes tradable and gains value, you’ll likely owe tax.

What if the tokens are locked or staked?

If the tokens are vested, time-locked, or inaccessible, the tax might be deferred until they become usable.

How to Stay Compliant (and Sane)

Here are best practices to avoid tax headaches from airdrops and giveaways:

1. Track Everything

Use a crypto tax software like Koinly, or CoinTracker to automatically import wallet transactions.

Maintain a simple spreadsheet with:

Date received

Token name

Quantity

Price at time of receipt

Value in USD

2. Set Aside Taxes

If you’re receiving frequent airdrops or giveaways, consider setting aside 20–30% of the value in fiat or stablecoins to cover your tax bill when it's due.

3. Avoid Spam or Scam Airdrops

Some airdrops are traps—tokens that entice you to connect wallets or approve malicious smart contracts. If it’s unsolicited and seems shady, don’t interact. Not only is it dangerous—it could also create an unexpected tax liability.

4. Use Tax-Loss Harvesting

If you received an airdrop that later tanks in value, you might be able to sell it at a loss to offset gains elsewhere in your portfolio.

Real-Life Example: The $UNI Airdrop

Let’s look at the famous Uniswap airdrop of 2020.

Uniswap gave 400 $UNI tokens to anyone who had used the protocol before September 2020. At the time of the drop, $UNI was trading around $3.

Here's how it played out:

400 tokens x $3 = $1,200 of ordinary income

If you sold later at $20 = $8,000 total

Your capital gain = $8,000 - $1,200 = $6,800

So, the recipient had to:

Report $1,200 as income

Report $6,800 as capital gains when they sold

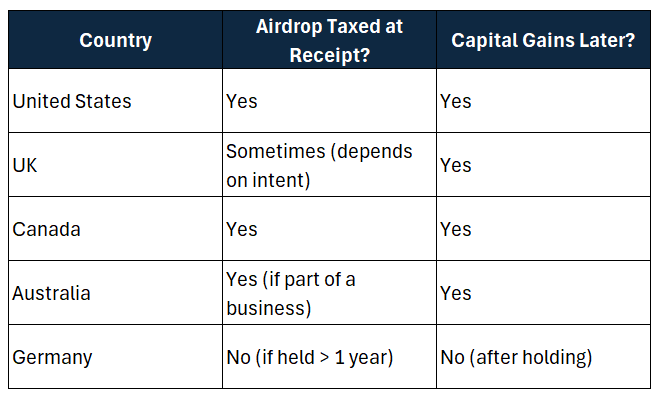

International Tax Treatment

The tax treatment of crypto airdrops and giveaways varies by country:

Always check your local tax authority's guidance—or speak to a crypto tax professional in your jurisdiction.

Conclusion: Free Isn’t Really Free (in Taxes)

Receiving free crypto through airdrops or giveaways might feel like a win—but the IRS treats these rewards as taxable income the moment they hit your wallet.

Key takeaways:

Airdrops and giveaways are generally taxed as ordinary income at FMV upon receipt.

Selling them later creates a capital gain/loss event.

You’re responsible for tracking and reporting everything accurately.

Good recordkeeping and tax tools can save you from major penalties or surprises.

As the crypto industry matures, tax authorities are watching more closely. The more proactive and informed you are, the less likely you are to run into problems.

Bonus Tip: If you’re frequently receiving airdrops or entering giveaways, consider using a tax automation tool like Koinly or CoinLedger to integrate directly with your wallets. You can even monetize your audience with affiliate links to these tools while educating others about compliance.

DISCLAIMER: The views and opinions expressed are those of the authors and do not necessarily reflect the official policy or position of CoinFlask. Do your own research. This is not financial advice