The Tax Treatment of Crypto Staking Pools and Rewards: A Beginner’s Guide

Cryptocurrency staking has become a popular way for holders to earn passive income, but with this opportunity comes a responsibility many users overlook—taxation. Whether you're staking directly on a blockchain, joining a staking pool, or using a third-party platform, it's essential to understand how staking rewards are taxed in the eyes of the IRS (and other tax authorities around the world). This article breaks down the tax implications of crypto staking and staking pools in simple terms so that even if you're new to crypto or taxes, you can keep your records clean and your peace of mind intact.

What is Crypto Staking?

In simple terms, staking is the process of locking up your cryptocurrency to help secure a proof-of-stake (PoS) blockchain network. In return, you receive staking rewards—usually more of the same cryptocurrency—as compensation for your participation. Think of it as earning interest in a traditional savings account, but for crypto.

There are three main ways people stake:

Solo Staking: You run your own node and stake your own coins.

Staking Pools: You combine your coins with others in a shared pool for a portion of the rewards.

Centralized Staking Platforms: Exchanges like Coinbase or Kraken offer staking services on your behalf.

Why Does the IRS Care About Staking?

Because you’re earning something of value—new tokens—staking rewards are considered income. The IRS treats this like interest or payment for services, which means it’s taxable at the time you receive it, not just when you sell it.

Key Principle: The fair market value (FMV) of the staking reward on the day you receive it is considered taxable income.

This can create a tricky tax situation because, unlike a paycheck, staking rewards often arrive in small increments and at odd intervals. That makes tracking essential.

The Taxation of Staking Rewards

1. Ordinary Income Tax on Receipt

When you receive staking rewards, they are taxed as ordinary income, similar to wages or interest. Here’s how that works:

If you receive 1.2 ETH in staking rewards on July 1st, and ETH is worth $3,000 at that time, you must report $3,600 as income.

The income is included in your gross income and subject to federal (and possibly state) income tax at your applicable marginal rate.

Note: This applies regardless of whether you stake through your own node, a pool, or a centralized exchange. The method of staking doesn't exempt you from income tax reporting.

2. Capital Gains Tax on Sale

Once you’ve received staking rewards, those assets become part of your crypto holdings. If you later sell or swap them, capital gains tax applies to any profit (or loss) from the original value when received to the value at the time of disposal.

Example:

You received 0.5 SOL as a staking reward when it was worth $100.

You sell that 0.5 SOL six months later for $150.

You report $100 as ordinary income on the day you received it.

The $50 difference is treated as a capital gain (short-term or long-term depending on the holding period).

How Staking Pools Affect Taxation

Joining a staking pool doesn’t change your tax responsibilities, but it does affect how you track and report the rewards.

In a staking pool:

You contribute your crypto to a shared pool, which is then staked collectively.

Rewards are distributed proportionally to all participants, often on a daily or weekly basis.

You still:

Recognize income when rewards are credited to you.

Use the FMV of the asset on the date received for your income tax.

Track each batch for future capital gains/losses.

Centralized Platforms: Simplified, But Not Simpler for Taxes

Platforms like Coinbase or Kraken make staking accessible but don’t always provide detailed tax-ready reports. You may:

Not know the exact timestamp of each reward.

Miss fair market value at receipt.

Have rewards automatically reinvested, complicating tracking.

You may need to rely on crypto tax software like Koinly, or CoinTracker to:

Import transactions via API.

Calculate FMV at the moment of each staking reward.

Track basis for future capital gains.

Pro Tip: Make sure the software supports staking income categorization, not just buy/sell transactions.

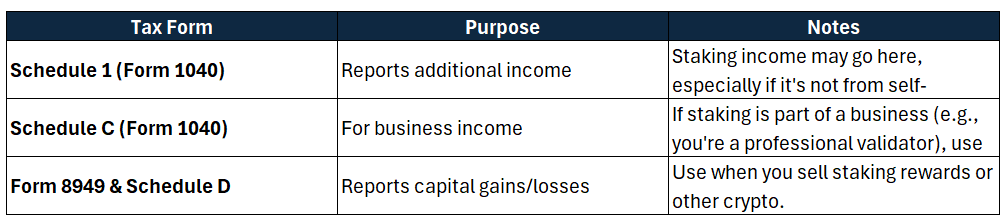

Reporting Staking Rewards on Your Tax Return

Here’s a quick breakdown of how to report staking rewards:

What If I Re-Stake My Rewards?

Many platforms automatically compound staking rewards, meaning you earn rewards on top of rewards. Each time new tokens are credited—even if restaked—they’re considered new income events. So yes, you may be taxed on:

Rewards that you never withdrew

Even if they’re locked or illiquid temporarily

This can lead to phantom income—you're taxed on gains you can't sell yet. It's an unfortunate reality of the current U.S. tax regime.

IRS Guidance: Is It Clear?

The IRS has released guidance on crypto income, but staking remains a gray area in some ways.

The IRS explicitly mentions mining rewards as income, but has not issued specific staking guidance (as of May 2025).

However, Notice 2014-21 is still cited as a framework, and it categorizes crypto earned through proof-of-work as income upon receipt. Most CPAs and crypto tax attorneys treat staking the same way by analogy.

A 2023 case (Jarrett v. U.S.) challenged this interpretation, but the IRS refunded the tax before it could go to trial, leaving no clear precedent.

So while not explicitly settled law, staking is almost universally treated as income by tax professionals to avoid audit risk.

Staking as a Business: When to Use Schedule C

If you’re running a validator node, have significant infrastructure, and earn regular income through staking, the IRS may consider this self-employment income.

This means:

You file Schedule C

You may be subject to self-employment tax (~15.3%)

You may deduct business-related expenses like:

Equipment

Internet costs

Electricity

Software subscriptions

If you're casually staking through a pool or platform, Schedule 1 is more appropriate.

International Tax Considerations

Different countries treat staking income differently:

UK: Treated as income when received, and capital gains on sale.

Canada: Taxed based on whether it’s business or personal activity.

Germany: Rewards held more than 1 year may be tax-free upon sale.

Australia: Staking rewards are ordinary income, even if not sold.

Always consult a tax advisor in your local jurisdiction.

Common Pitfalls to Avoid

Failing to Report

Just because staking income isn’t sent on a 1099 doesn’t mean it’s not taxable. You must report it.Incorrect FMV Estimates

Using the wrong price when received can distort your tax bill. Use price aggregators or tax tools with accurate timestamp pricing.Mixing Pooled and Personal Funds

Keep wallet addresses separate to avoid confusion between personal staking and pooled staking.Not Tracking Restaked Rewards

Compounding rewards can create dozens of taxable events. Automate this with software.Ignoring State Taxes

Some states, like California or New York, also tax staking income. Know your local laws.

Final Thoughts

Staking can be a rewarding way to grow your crypto portfolio—but that growth doesn’t come tax-free. Whether you’re staking solo, in a pool, or on a centralized platform, you are likely incurring taxable income at the time the rewards are received. Additionally, any later sale of those rewards may trigger capital gains tax.

To stay compliant:

Track rewards diligently.

Report income annually.

Use crypto tax tools.

Consider speaking with a tax professional—especially if you're staking large amounts or operating as a validator.

As crypto tax policy evolves, staying informed will be the key to turning your staking rewards into a sustainable and tax-efficient income stream.

DISCLAIMER: The views and opinions expressed are those of the authors and do not necessarily reflect the official policy or position of CoinFlask. Do your own research. This is not financial advice.