Reporting Crypto Transactions in Cryptocurrency-Friendly Countries

Cryptocurrency is no longer the fringe curiosity it once was. From casual Bitcoin traders to NFT collectors and full-on DeFi farmers, millions of people now engage with digital assets daily. But just because your crypto might be decentralized doesn’t mean it’s free from government oversight—especially when it comes to taxes.

However, not all countries treat crypto the same. Some have embraced it with open arms, offering more favorable tax rules, lighter reporting burdens, or even complete tax exemptions. These are the so-called cryptocurrency-friendly countries.

In this article, we’ll break down what reporting your crypto transactions looks like in such jurisdictions, why it still matters even when taxes are light, and how you can stay compliant while taking advantage of favorable laws.

Why Reporting Matters, Even in Crypto Havens

It’s easy to assume that living in a crypto-friendly country means you can completely ignore taxes or financial reporting. Not quite. Even in countries with 0% capital gains tax on crypto, you may still need to report holdings, trades, or income under certain conditions.

Here’s why reporting matters:

Banking and fiat on-ramps: To cash out crypto or move money across borders, you’ll often need to verify the source of your funds.

Audit protection: In places where crypto gains are tax-free, reporting transactions can still protect you in case the rules change or a regulator audits your finances.

Residency and citizenship tests: Some jurisdictions base tax obligations on how much time you spend in the country or where you earn income. Reporting ensures you remain in compliance with those thresholds.

What Qualifies as a Crypto-Friendly Country?

Generally, these countries:

Have low or zero capital gains tax on crypto.

Don’t consider crypto as legal tender but allow broad use of it.

Have clear tax policies (or beneficial gray areas).

Do not aggressively pursue reporting requirements for small holders or traders.

Examples include:

Portugal

United Arab Emirates (UAE)

El Salvador

Singapore

Switzerland

Malta

Germany (with conditions)

Each country treats crypto differently, though. Let’s break them down.

Country-By-Country Breakdown: Reporting Rules

1. Portugal

Portugal has become a crypto hotspot for expats—and for good reason.

Capital gains: As of 2023, crypto held longer than 365 days is exempt from capital gains tax.

Short-term trades: Profits made from assets held under a year may be taxed at 28%, but only if you’re considered a “habitual trader.”

Reporting: No formal requirement to declare crypto holdings, but reporting may be necessary if you’re transferring large sums through banks or involved in business activities like mining or staking.

Staking & mining: These are now taxed as income. So, reporting is required for those earning from validation or block rewards.

Takeaway: If you're holding long-term or using crypto casually, Portugal is light on reporting. Just be careful if you're running a business.

2. United Arab Emirates (UAE)

The UAE, especially Dubai, is one of the most tax-efficient crypto hubs in the world.

Capital gains: No tax on personal crypto gains.

Corporate activity: If you operate as a registered business, especially in a Free Zone, you may be subject to corporate tax (as of mid-2023, a 9% rate applies to qualifying businesses).

Reporting: For individuals, there’s no mandatory crypto reporting at the federal level. However, if you're applying for a residency visa through investment, you may need to disclose your digital asset holdings.

Takeaway: Personal trading is off the radar—but businesses need to tread carefully.

3. El Salvador

Famously made Bitcoin legal tender in 2021.

Capital gains: Foreigners are exempt from paying tax on Bitcoin gains.

Domestic business: If you’re operating a business and accepting BTC, you still must account for transactions in USD (El Salvador’s other official currency) for tax reporting.

Reporting: Minimal requirements for personal use, but businesses must report income, even if received in BTC.

Takeaway: Ideal for personal Bitcoin usage, but transparent reporting is required for business accounting.

4. Singapore

Singapore treats crypto like property, not currency.

Capital gains: No tax on capital gains, whether from crypto or stocks.

Income tax: If crypto is part of your business operations—like mining, staking, or running a tokenized platform—profits are taxed as business income.

Reporting: Businesses must report crypto-derived income. Individuals who casually buy and sell crypto don’t need to report anything unless they’re actively earning income.

Takeaway: Easy ride for investors, but businesses and high-volume traders need to keep records.

5. Switzerland

Known for its banking privacy and wealth management culture.

Capital gains: Tax-free for private individuals, as long as trading isn’t a professional activity.

Wealth tax: You must declare your crypto holdings annually for the wealth tax, based on the coin’s fair market value on December 31.

Staking and mining: Taxed as income and must be reported.

Reporting: Required for wealth tax purposes, even if you owe no tax on gains.

Takeaway: Crypto is reportable for wealth tracking, but gains are generally safe from capital gains tax.

6. Malta

A strong contender for crypto business incorporation.

Capital gains: Long-term individual holdings are not taxed.

Day trading or business income: Taxable under business income rules.

Reporting: Companies must report crypto in financial statements. Individuals don’t have explicit requirements unless engaging in business.

Takeaway: Crypto business is heavily regulated, but individual investors have minimal obligations.

7. Germany

Germany is friendly, if you’re patient.

Capital gains: Crypto held for over a year is completely tax-free.

Less than a year: Taxable if gains exceed €600.

Staking/interest: These reset the 1-year holding clock to 10 years if rewards are earned.

Reporting: Required if taxable events occur or if you cross income thresholds.

Takeaway: Ideal for HODLers—but keep careful logs to track those holding periods.

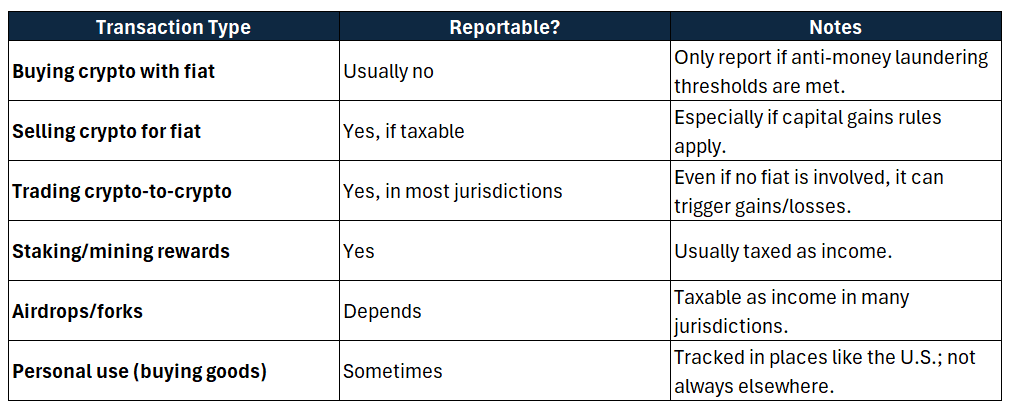

Key Crypto Transaction Types and When to Report

In crypto-friendly countries, not every transaction needs to be reported, but it depends on the nature of the transaction.

Record-Keeping Tips for Crypto-Friendly Jurisdictions

Even when taxes are low or zero, record-keeping is critical:

Track acquisition dates and holding periods.

Maintain wallet addresses and exchange history.

Export data from wallets, exchanges, and DeFi apps regularly.

Use a crypto tax software like Koinly, or CoinTracker even if you're just tracking—not filing.

Common Mistakes to Avoid

Thinking you don’t need to report anything – Crypto-friendliness doesn’t mean lawlessness.

Ignoring income from staking, airdrops, or mining – These are often taxed differently from trading.

Mixing personal and business wallets – Especially in places like the UAE or Singapore, this can trigger compliance issues.

Relying on anonymous wallets – Without records, proving your funds are legitimate could be hard during audits or bank transfers.

The Nomad Strategy: Moving Across Friendly Jurisdictions

Digital nomads often use this strategy to minimize taxes:

Live in a tax-free crypto haven (e.g., Dubai, Portugal) for most of the year.

Avoid triggering tax residency in high-tax countries.

Cash out or rebalance portfolios in countries with zero capital gains tax.

File residency declarations and maintain strong proof of ties (leases, bank accounts, ID registrations).

But beware: many high-tax countries have exit taxes, and you may still owe taxes on gains accrued before becoming a resident elsewhere.

Final Thoughts: Play Smart, Stay Clean

Being in a crypto-friendly country gives you a huge leg up—but it doesn’t exempt you from responsibility. Whether you’re staking ETH, trading NFTs, or just dollar-cost averaging into Bitcoin, you need a clear picture of what’s reportable and what’s not.

In short:

Learn the tax code where you live (and where you plan to move).

Keep accurate records.

Use tracking software.

Report when required, even if the taxes are minimal.

Because when regulators come knocking, “But I live in a crypto haven!” isn’t a defense—it’s a lifestyle choice that still comes with responsibilities.

DISCLAIMER: The views and opinions expressed are those of the authors and do not necessarily reflect the official policy or position of CoinFlask. Do your own research. This is not financial advice